Is There Tax On Food In Texas . However, not all food items are subject to sales tax. are food and meals subject to sales tax? yes, there is sales tax on food in texas. learn when to charge sales tax on food in texas, including groceries, meals, beverages, snacks, bakery food. yes, there is a sales tax on food in texas. In texas, most food items are subject to sales tax. learn about the taxable and nontaxable items sold by grocery and convenience stores in texas. While texas' sales tax generally applies to most transactions, certain items have. texas has a 6.25% sales and use tax on all retail sales, but there are some tax exemptions when it comes to food. learn how to distinguish between taxable and exempt food items in texas, and how sales tax applies to online food delivery and restaurants.

from bluevirginia.us

learn when to charge sales tax on food in texas, including groceries, meals, beverages, snacks, bakery food. texas has a 6.25% sales and use tax on all retail sales, but there are some tax exemptions when it comes to food. learn about the taxable and nontaxable items sold by grocery and convenience stores in texas. yes, there is sales tax on food in texas. While texas' sales tax generally applies to most transactions, certain items have. In texas, most food items are subject to sales tax. yes, there is a sales tax on food in texas. However, not all food items are subject to sales tax. are food and meals subject to sales tax? learn how to distinguish between taxable and exempt food items in texas, and how sales tax applies to online food delivery and restaurants.

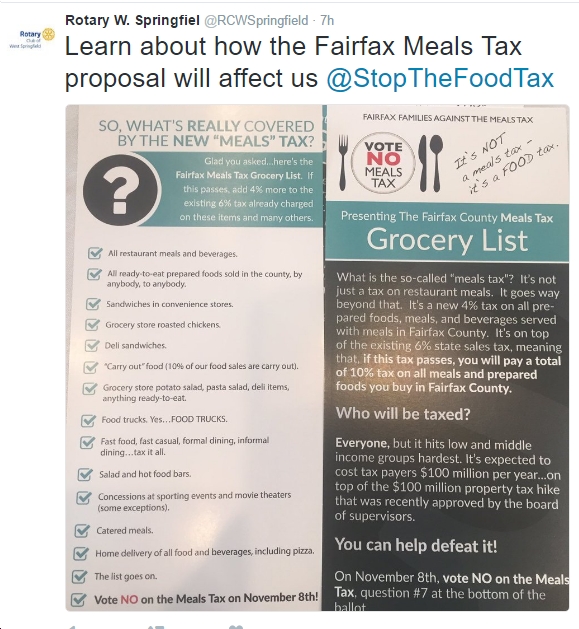

Who’s Behind the “Stop the Food Tax” Organization in Fairfax County

Is There Tax On Food In Texas However, not all food items are subject to sales tax. learn how to distinguish between taxable and exempt food items in texas, and how sales tax applies to online food delivery and restaurants. yes, there is sales tax on food in texas. learn when to charge sales tax on food in texas, including groceries, meals, beverages, snacks, bakery food. texas has a 6.25% sales and use tax on all retail sales, but there are some tax exemptions when it comes to food. learn about the taxable and nontaxable items sold by grocery and convenience stores in texas. However, not all food items are subject to sales tax. While texas' sales tax generally applies to most transactions, certain items have. are food and meals subject to sales tax? In texas, most food items are subject to sales tax. yes, there is a sales tax on food in texas.

From taxfoundation.org

Does Your State Have a Gross Receipts Tax? State Gross Receipts Taxes Is There Tax On Food In Texas yes, there is sales tax on food in texas. texas has a 6.25% sales and use tax on all retail sales, but there are some tax exemptions when it comes to food. learn how to distinguish between taxable and exempt food items in texas, and how sales tax applies to online food delivery and restaurants. learn. Is There Tax On Food In Texas.

From woltersworld.com

5 Foods You Have to Eat in Texas Wolters World Is There Tax On Food In Texas are food and meals subject to sales tax? texas has a 6.25% sales and use tax on all retail sales, but there are some tax exemptions when it comes to food. learn about the taxable and nontaxable items sold by grocery and convenience stores in texas. yes, there is a sales tax on food in texas.. Is There Tax On Food In Texas.

From bluevirginia.us

Who’s Behind the “Stop the Food Tax” Organization in Fairfax County Is There Tax On Food In Texas learn about the taxable and nontaxable items sold by grocery and convenience stores in texas. learn when to charge sales tax on food in texas, including groceries, meals, beverages, snacks, bakery food. However, not all food items are subject to sales tax. yes, there is sales tax on food in texas. yes, there is a sales. Is There Tax On Food In Texas.

From everytexan.org

Who Pays Texas Taxes? Every Texan Is There Tax On Food In Texas learn how to distinguish between taxable and exempt food items in texas, and how sales tax applies to online food delivery and restaurants. yes, there is sales tax on food in texas. In texas, most food items are subject to sales tax. are food and meals subject to sales tax? learn when to charge sales tax. Is There Tax On Food In Texas.

From www.texasrealestatesource.com

Lowest Property Taxes in Texas 5 Counties with Low Tax Rates Is There Tax On Food In Texas learn when to charge sales tax on food in texas, including groceries, meals, beverages, snacks, bakery food. are food and meals subject to sales tax? yes, there is a sales tax on food in texas. However, not all food items are subject to sales tax. learn about the taxable and nontaxable items sold by grocery and. Is There Tax On Food In Texas.

From www.nmvoices.org

A Health Impact Assessment of a Food Tax in New Mexico New Mexico Is There Tax On Food In Texas texas has a 6.25% sales and use tax on all retail sales, but there are some tax exemptions when it comes to food. learn how to distinguish between taxable and exempt food items in texas, and how sales tax applies to online food delivery and restaurants. yes, there is a sales tax on food in texas. . Is There Tax On Food In Texas.

From www.cbpp.org

Which States Tax the Sale of Food for Home Consumption in 2017 Is There Tax On Food In Texas learn how to distinguish between taxable and exempt food items in texas, and how sales tax applies to online food delivery and restaurants. yes, there is a sales tax on food in texas. yes, there is sales tax on food in texas. texas has a 6.25% sales and use tax on all retail sales, but there. Is There Tax On Food In Texas.

From www.texasrealestatesource.com

How Do Property Taxes Work in Texas? Texas Property Tax Guide Is There Tax On Food In Texas yes, there is a sales tax on food in texas. However, not all food items are subject to sales tax. learn about the taxable and nontaxable items sold by grocery and convenience stores in texas. learn how to distinguish between taxable and exempt food items in texas, and how sales tax applies to online food delivery and. Is There Tax On Food In Texas.

From giotvwqho.blob.core.windows.net

Is There Sales Tax On Dog Food In Texas at Josephine Placencia blog Is There Tax On Food In Texas texas has a 6.25% sales and use tax on all retail sales, but there are some tax exemptions when it comes to food. yes, there is a sales tax on food in texas. However, not all food items are subject to sales tax. learn how to distinguish between taxable and exempt food items in texas, and how. Is There Tax On Food In Texas.

From ieltsfever.net

Many Countries Has Recently Introduced Special Taxes on Foods Is There Tax On Food In Texas learn about the taxable and nontaxable items sold by grocery and convenience stores in texas. learn when to charge sales tax on food in texas, including groceries, meals, beverages, snacks, bakery food. yes, there is sales tax on food in texas. are food and meals subject to sales tax? yes, there is a sales tax. Is There Tax On Food In Texas.

From hxextqpmz.blob.core.windows.net

Is Food Taxable In Texas at John Dye blog Is There Tax On Food In Texas are food and meals subject to sales tax? However, not all food items are subject to sales tax. learn about the taxable and nontaxable items sold by grocery and convenience stores in texas. yes, there is sales tax on food in texas. learn when to charge sales tax on food in texas, including groceries, meals, beverages,. Is There Tax On Food In Texas.

From everytexan.org

The Staggering Unfairness of our State Tax System Every Texan Is There Tax On Food In Texas However, not all food items are subject to sales tax. texas has a 6.25% sales and use tax on all retail sales, but there are some tax exemptions when it comes to food. yes, there is a sales tax on food in texas. learn about the taxable and nontaxable items sold by grocery and convenience stores in. Is There Tax On Food In Texas.

From taxsalestoday.blogspot.com

Tax Sales State Tax Sales Texas Is There Tax On Food In Texas learn when to charge sales tax on food in texas, including groceries, meals, beverages, snacks, bakery food. texas has a 6.25% sales and use tax on all retail sales, but there are some tax exemptions when it comes to food. In texas, most food items are subject to sales tax. yes, there is sales tax on food. Is There Tax On Food In Texas.

From www.youtube.com

Which US states tax food? YouTube Is There Tax On Food In Texas learn how to distinguish between taxable and exempt food items in texas, and how sales tax applies to online food delivery and restaurants. learn about the taxable and nontaxable items sold by grocery and convenience stores in texas. yes, there is sales tax on food in texas. While texas' sales tax generally applies to most transactions, certain. Is There Tax On Food In Texas.

From www.facebook.com

Facebook Is There Tax On Food In Texas texas has a 6.25% sales and use tax on all retail sales, but there are some tax exemptions when it comes to food. However, not all food items are subject to sales tax. learn about the taxable and nontaxable items sold by grocery and convenience stores in texas. learn when to charge sales tax on food in. Is There Tax On Food In Texas.

From www.tastingtable.com

16 Iconic Foods That Originated In Texas Is There Tax On Food In Texas are food and meals subject to sales tax? However, not all food items are subject to sales tax. In texas, most food items are subject to sales tax. learn about the taxable and nontaxable items sold by grocery and convenience stores in texas. texas has a 6.25% sales and use tax on all retail sales, but there. Is There Tax On Food In Texas.

From everytexan.org

Who Pays Texas Taxes? (2023) Every Texan Is There Tax On Food In Texas are food and meals subject to sales tax? learn how to distinguish between taxable and exempt food items in texas, and how sales tax applies to online food delivery and restaurants. However, not all food items are subject to sales tax. learn about the taxable and nontaxable items sold by grocery and convenience stores in texas. . Is There Tax On Food In Texas.

From www.cbpp.org

States That Still Impose Sales Taxes on Groceries Should Consider Is There Tax On Food In Texas In texas, most food items are subject to sales tax. However, not all food items are subject to sales tax. learn about the taxable and nontaxable items sold by grocery and convenience stores in texas. learn how to distinguish between taxable and exempt food items in texas, and how sales tax applies to online food delivery and restaurants.. Is There Tax On Food In Texas.